It is used to determine outcomes in legal cases, investigate embezzlement, and provide evidence to support financial crime investigations. Financial forecasting informs about the expected revenues, expenses, and cash flow in the near future, helping companies prepare for risks and take advantage of opportunities. Forecasting allows the company to be flexible and agile in dealing with market changes.

Government accounting

In addition to auditing, assisting with tax returns, providing legal advice, or consulting on technology installation or computer software, this could include auditing work. In fiduciary accounting, individuals handle accounts entrusted to property custody or management. This branch keeps track of receipts and disbursements from accounts to ensure proper fund allocations, and guardians and custodians frequently use it. An organization considers fixed costs to be constant and unchanging, such as rent, while variable costs are changing expenses, such as shipping charges. Accounting Tools examine how these costs affect a business and how they can be better managed. For determining such criteria, a company must use different concepts for different issues, not just one accounting branch.

AI, ML and Data Science

It aims to ensure that an entity fulfills its tax obligations efficiently. Nonprofit accounting helps keep organizations transparent, by tracking donations, grants and fundraising activities. Transparent financial reporting helps maintain and build goodwill among donors by showing that revenue is used responsibly and for intended purposes.

- Consider your interests, career goals, and the knowledge and skills you want to acquire to make the best decision for your future.

- They would also be involved in calculating and filing taxes in each jurisdiction where the company operates.

- It provides historical information to guide future project decisions, such as cost-cutting strategies or budget changes.

- Nonprofit accounting is one of the branches of accounting that focuses on the specialized financial management needs of charitable and nonprofit organizations.

- The finance module within the ERP system would function as an accounting information system.

What is your current financial priority?

It provides a clear picture of the financial health of your organization and its performance, which can serve as a catalyst for resource management and strategic growth. In the Financial Accounting Series, you will study about the various aspects of financial accounting and how financial reports are prepared. Cost accounting and management accounting are separate areas of study which are beyond the scope of this book.

Branches of Accounting: Functions and Their Importance Explained

Forensic accounting involves court and litigation cases, fraud investigation, claims and dispute resolution, and other areas that involve legal matters. As your organization navigates the complexities of today’s dynamic economic environment, a reasonable selection of the accounting branch will align well with your organizational goals. Harnessing data analytics tools helps accountants extract meaningful the 18th amendment insights and contribute to data-driven decision-making processes. Accountants’ roles are transforming in response to the changing business and regulatory environments. Traditionally perceived as number crunchers and record keepers, accountants are increasingly becoming strategic partners in organizational decision-making. This evolution can be due to the following trends shaping the role of accountants.

Financial closing processes

They perform various business functions such as the preparation of financial reports, payroll and cash management. Accounting is the process of keeping track of all financial transactions within a business, such as any money coming in and money going out. It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes. Though many businesses leave their accounting to the pros, it’s wise to understand the basics of accounting if you’re running a business.

Consider the reporting needs of stakeholders, like investors, creditors, and regulatory bodies. Financial accounting is ideal for external reporting, while managerial accounting focuses on providing internal reports for management decision-making. Larger enterprises may benefit from more intricate methods like international accounting. Similarly, small businesses might find cost accounting or financial accounting more suitable.

Non-profit organizations (NPO) and fund accounting collaborate to ensure the accurate and proper allocation of funds. Fund accountants separate and distribute funds in accordance with the company’s policies or the laws governing NPOs to ensure that NPO funds are distributed as intended. During a state or federal audit, an impartial, external auditor checks the accuracy of a company’s financial statements. GAAP-compliant auditing assesses the effectiveness of a company’s internal controls. External auditors may examine the effectiveness and integrity of the company’s policies, authorizations, and other management controls.

Taxation accounting deals with the preparation and reporting of information that will be used by tax authorities. Financial accounting deals with the preparation and reporting of information that provides an indication about a business or nonprofit organization’s finances to external. It also helps in measuring and controlling costs and, in this way, increases profits. They will make sure that any funds that are taken in are handled correctly and accurately. They will work according to company policy, or in accordance with the laws that govern NPOs. The need for international accounting expands alongside growth within international markets.

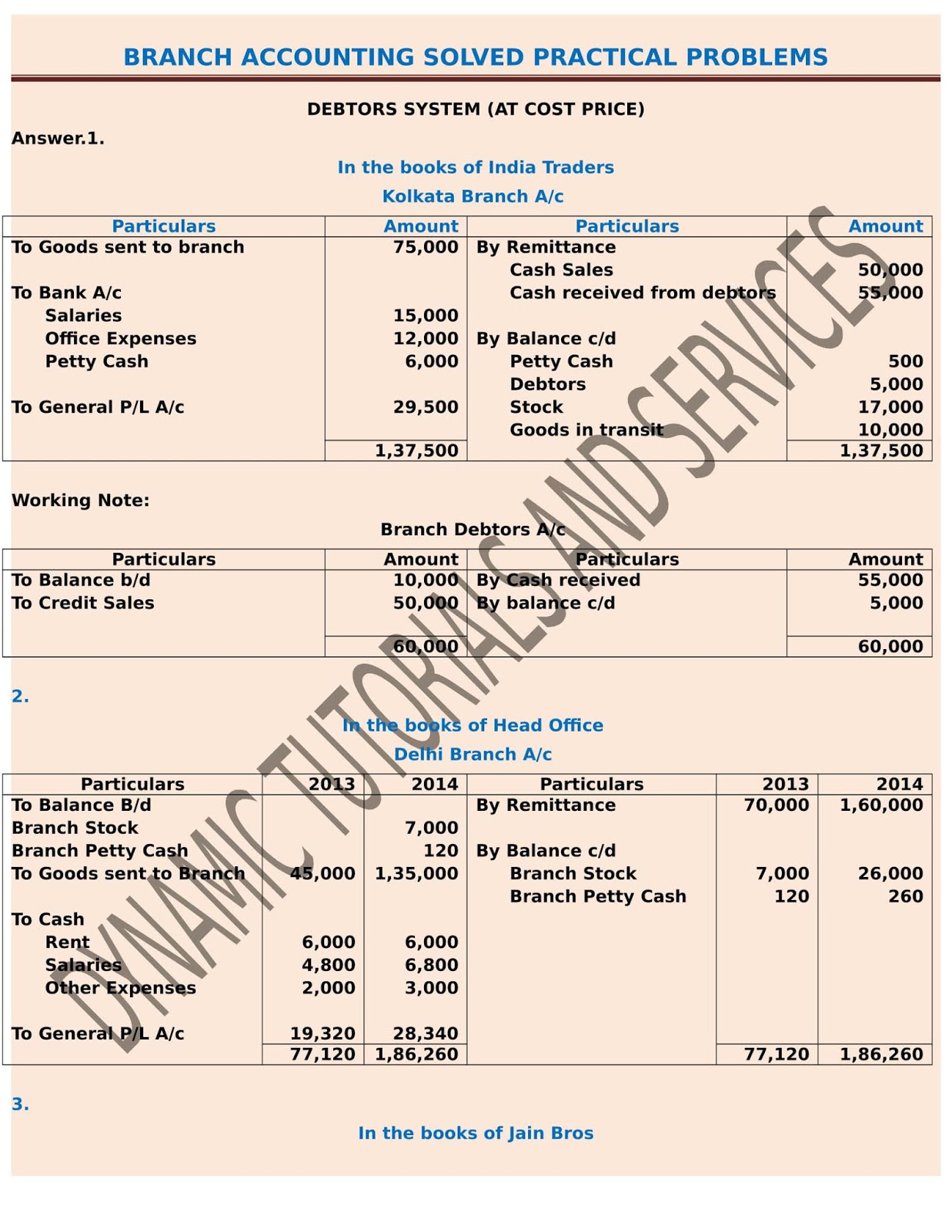

Did you know that in the history of accounting, Luca Pacioli is often called the father of accounting? His Summa de Arithmetica, Geometria, Proportioni et Proportionalita, written in 1494, outlined Venetian merchants’ first double-entry bookkeeping system. #3 – Head Office Paid Expenses of Branch – If the head office paid wages of $500, rent of $400, and salary of $300 on behalf of the branch. #1 – Inventory – If the head office transferred inventory of $1,000 to its branch office, the journal entries below would be passed into the head office books. If you want to focus on a specialization, you may want to consider obtaining an accounting certification in your chosen field.