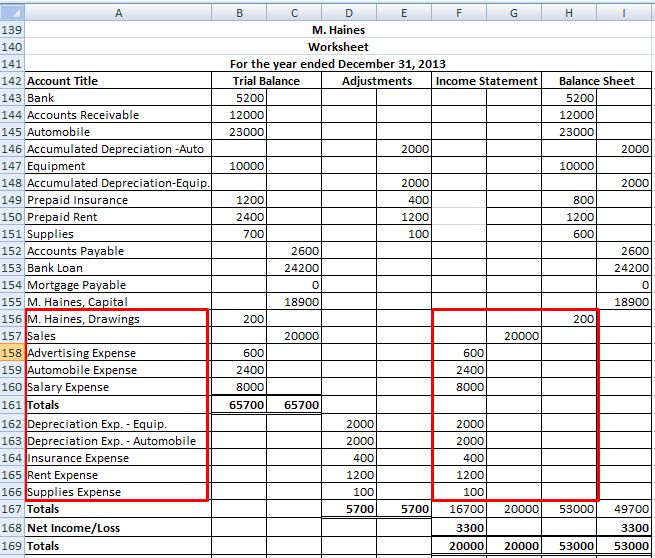

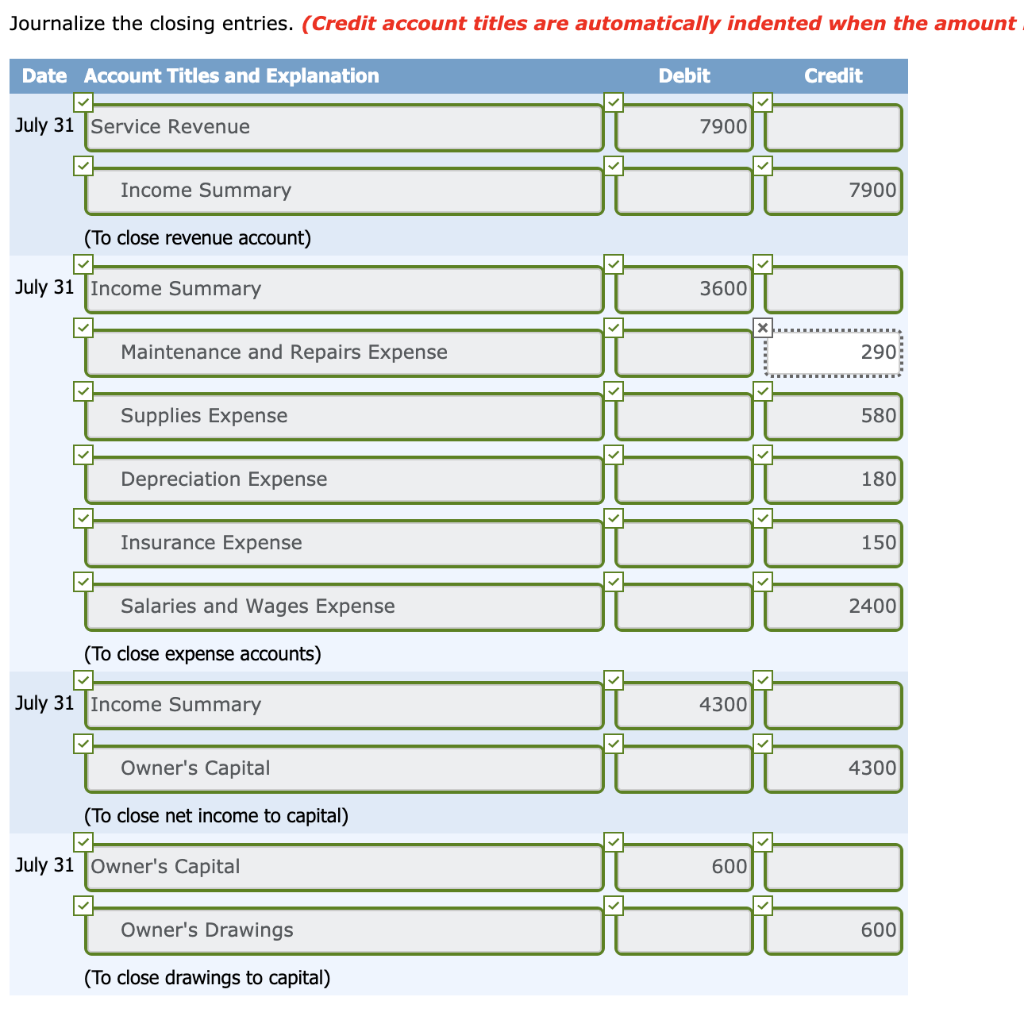

Thus, the income summary temporarily holds only revenue and expense balances. Remember that all revenue, sales, income, and gain accounts are closed in this entry. The month-end close is when a business collects financial accounting information. Using the above steps, let’s go through an example of what the closing entry process may look like.

Unit 4: Completion of the Accounting Cycle

- Closing entries are mainly made to update the Retained Earnings to reflect the results of operations and to eliminate the balances in the revenue and expense accounts, enabling them to be used again in a subsequent period.

- For example, closing an income summary involves transferring its balance to retained earnings.

- Thebusiness has been operating for several years but does not have theresources for accounting software.

- One such expense that’s determined at the end of the year is dividends.

If you own a sole proprietorship, you have to close temporary accounts to the owner’s equity instead of retained earnings. Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account. Essentially resetting the account balances to zero on the general ledger. A closing entry is a journal entry that’s made at the end of the accounting period that a business elects to use. It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement.

Double Entry Bookkeeping

In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

Step 1 of 3

The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors. In this case, if you paid out a dividend, the balance would be moved to retained earnings from the dividends account. Once this has been completed, a post-closing trial balance will be reviewed to ensure accuracy. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary.

This is the same figure found on the statement ofretained earnings. The fourth entry requires Dividends to close to the RetainedEarnings account. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns. However, most companies prepare monthlyfinancial statements and close their books annually, so they have aclear picture of company performance during the year, and giveusers timely information to make decisions.

Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period. The purpose of how to get your product in walmart is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are «restarted». Since the dividends account is not an income statement account, it is directly moved to the retained earnings account. You might be asking yourself, “is the Income Summary accounteven necessary? ” Could we just close out revenues and expensesdirectly into retained earnings and not have this extra temporaryaccount?

In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities.

All of these entries have emptied the revenue, expense, and income summary accounts, and shifted the net profit for the period to the retained earnings account. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. Now that the journal entries are prepared and posted, you are almost ready to start next year.

As you will see later, Income Summary is eventually closed to capital. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Notice that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. However, if the company also wanted to keep year-to-dateinformation from month to month, a separate set of records could bekept as the company progresses through the remaining months in theyear.

Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. So, if the closing entries journal is not posted, there will be incorrect reporting of financial statements. And not having an accurate depiction of change in retained earnings might mislead the investors about a company’s financial position. All these examples of closing entries in journals have been debited in the expense account.

Here you will focus on debiting all of your business’s revenue accounts. After closing both income and revenue accounts, the income summary account is also closed. All generated revenue of a period is transferred to retained earnings so that it is stored there for business use whenever needed. All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.