How to trade cryptocurrency

TapSwap is one of the most popular Telegram clicker games, as it has reached 68 million total players, who have combined for over 4 trillion taps. TapSwap has reached more than 6.6 https://regalassetsv.com/in-depth-regal-assets-review-are-they-a-trustworthy-precious-metals-company/ million followers on Twitter and close to 5 million subscribers on YouTube.

“Once that platform is fully implemented, you’ll be able to go online. And just like checking something out from Amazon, you’ll have options to pay with credit card, checking account and PayPal. PayPal cash or PayPal with crypto,” Patel said.

The top 10 cryptocurrencies are ranked by their market capitalization. Even though 10 is an arbitrarily selected number, being in the top 10 by market capitalization is a sign that the cryptocurrency enjoys a lot of relevance in the crypto market. The crypto top 10 changes frequently because of the high volatility of crypto prices. Despite this, Bitcoin and Ethereum have been ranked #1 and #2, respectively, for several years now.

Protocol tokens are also known as platform tokens. Protocol tokens represent a platform on which other projects build decentralized applications (DApps). Protocol tokens represent a store of value or a stake on the blockchain that they were issued on.

How to buy cryptocurrency

Cryptocurrencies markets are unregulated services which are not governed by any specific European regulatory framework (including MiFID) or in Seychelles. Therefore, when using our Cryptocurrencies Trading Service, you will not benefit from the protections available to clients receiving MiFID regulated investment services, such as access to the Cyprus Investor Compensation Fund (ICF)/the Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service for dispute resolution, or the protections available under Seychelles regulatory framework (as applicable).

Ethereum (ETH) The second-most popular crypto in terms of market capitalization, Ether (ETH) is the native asset of the Ethereum blockchain, which serves as a platform for decentralized applications (dapps) built via smart contracts. ETH fuels transactions on Ethereum. The network is best known for its decentralized finance (DeFi) applications and for the non-fungible tokens (NFTs) it supports.

When you decide on which cryptocurrency to purchase, you can enter its ticker symbol—Bitcoin, for instance is BTC—and how many coins you’d like to purchase. With most exchanges and brokers, you can purchase fractional shares of cryptocurrency, allowing you to buy a sliver of high-priced tokens like Bitcoin or Ethereum that otherwise take thousands to own.

Disclaimer: This page may contain affiliate links. CoinMarketCap may be compensated if you visit any affiliate links and you take certain actions such as signing up and transacting with these affiliate platforms. Please refer to Affiliate Disclosure

You can leave your crypto in the custody of a brokerage or exchange, but it’s important to know that you don’t technically own it when you do this. Instead, you own an IOU for your assets and can’t use them in a peer-to-peer transaction or put them to work in a dapp.

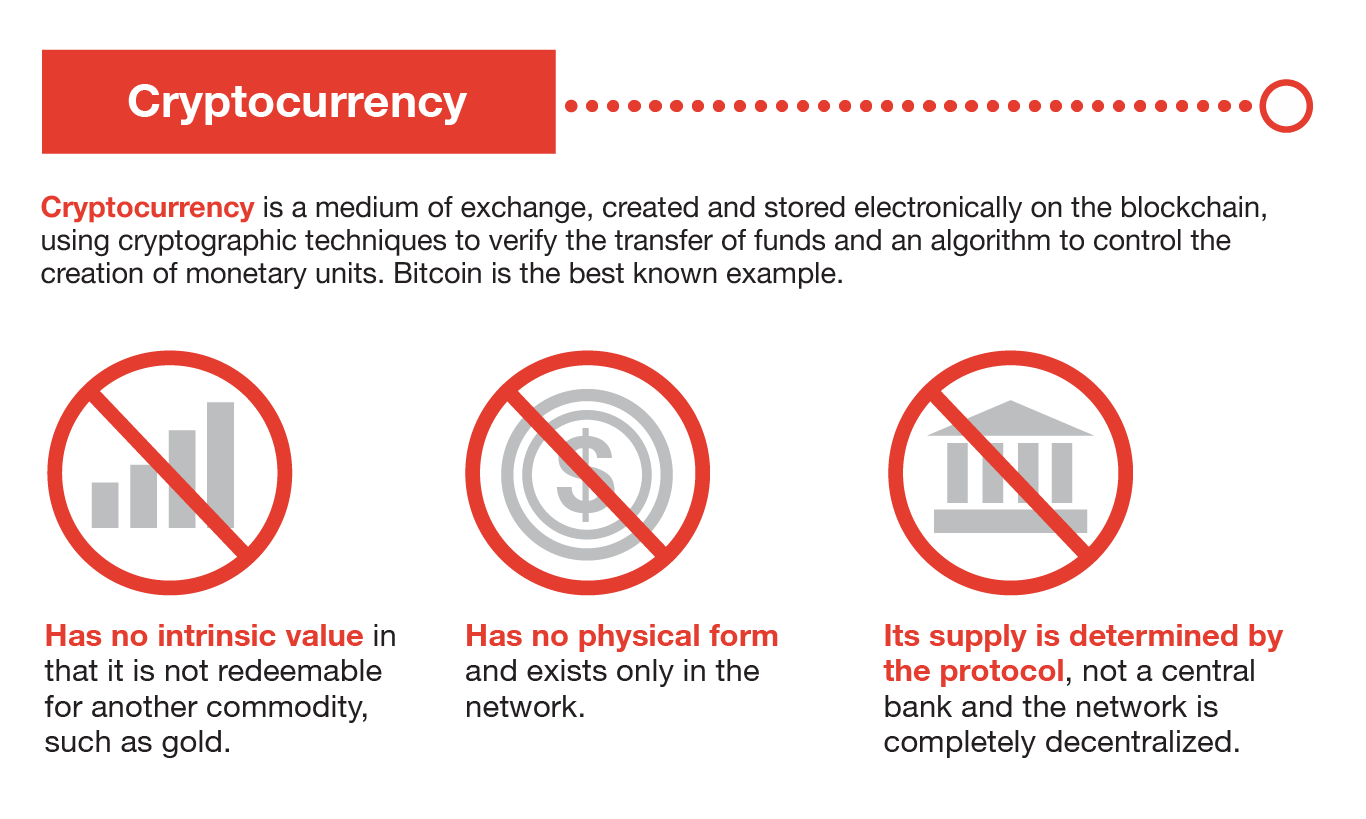

Cryptocurrency meaning

Node owners are either volunteers, those hosted by the organization or body responsible for developing the cryptocurrency blockchain network technology, or those who are enticed to host a node to receive rewards from hosting the node network.

In September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal. This completed a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.

In September 2017, China banned ICOs to cause abnormal return from cryptocurrency decreasing during announcement window. The liquidity changes by banning ICOs in China was temporarily negative while the liquidity effect became positive after news.

With more people entering the world of virtual currency, generating hashes for validation has become more complex over time, forcing miners to invest increasingly large sums of money to improve computing performance. Consequently, the reward for finding a hash has diminished and often does not justify the investment in equipment and cooling facilities (to mitigate the heat the equipment produces) and the electricity required to run them. Popular regions for mining include those with inexpensive electricity, a cold climate, and jurisdictions with clear and conducive regulations. By July 2019, bitcoin’s electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.

Node owners are either volunteers, those hosted by the organization or body responsible for developing the cryptocurrency blockchain network technology, or those who are enticed to host a node to receive rewards from hosting the node network.

In September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal. This completed a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.

Trade cryptocurrency

When trading crypto, it is crucial to remember that you also have to pay fees to crypto exchanges. You can achieve higher profitability if you have lower platform fees. But, on top of the crypto exchange fees, it is essential to know that crypto tax comes on top of the trading platform fees. Just like with crypto exchange fees, if tax is not accounted for, it can lower your profits.

Luckily, with cryptocurrency, most of the networks are public such as Bitcoin and Ethereum making access to these on-chain factors easy. To track both Bitcoin and Ethereum on-chain metrics, you can use Bitinfocharts.com. This website has loads of crypto-related data and is extremely simple to use and navigate.

If you own $10,000 worth of Bitcoin and want to hedge against a possible decrease in its price, you could buy a put option for a premium of $500 that gives you the right to sell bitcoin at $50,000 at a future date. If Bitcoin’s price falls to $40,000, you can exercise your option and sell your bitcoin for $50,000, significantly reducing your losses.

It depends on your goals. Looking for short-term gains, then scalping and day trading would be the best strategy for you. If, instead, you are looking for long-term gains, consider position trading or holding your coins over a long period (HODL).

Binance supports the widest selection of deposit/withdrawal options of any exchange currently and the widest geographical coverage as well. You can also download a mobile application on either iOS or Android and trade on the go.