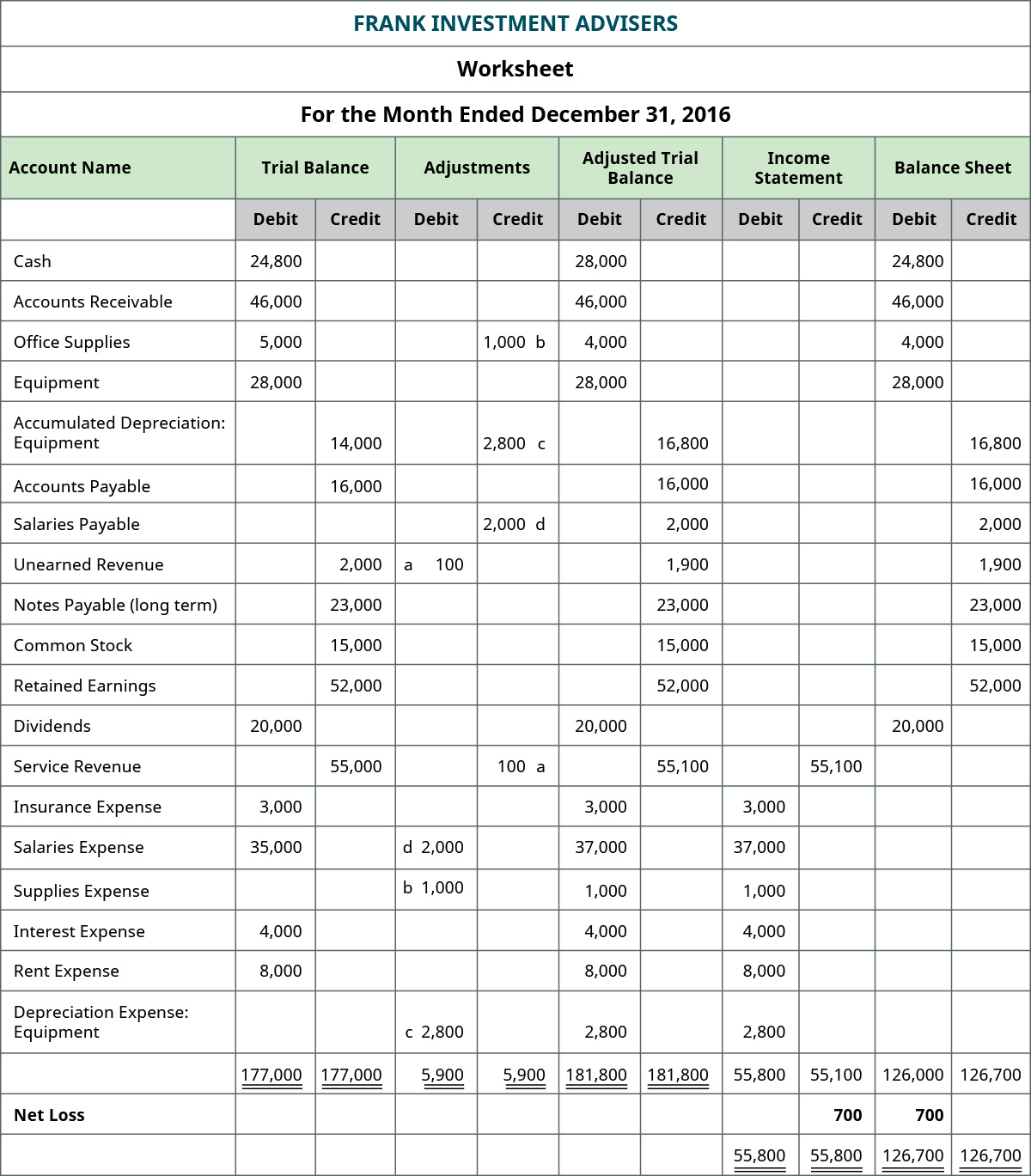

This balance istransferred to the Interest Receivable account in the debit columnon the adjusted trial balance. AccumulatedDepreciation–Equipment ($75), Salaries Payable ($1,500), UnearnedRevenue ($3,400), Service Revenue ($10,100), and Interest Revenue($140) all have credit final balances in their T-accounts. Thesecredit balances would transfer to the credit column on the adjustedtrial balance. Just like in the unadjusted trial balance, total debits and total credits should be equal. After posting the above entries, the values of some of the items in the unadjusted trial balance will change. However, most businesses can streamline this cycle and skip tedious steps like posting transactions to the general ledger and creating a trial balance.

Latest blog posts

This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Deferred (unearned) revenues are revenues received that are included in liabilities until they are “earned”. Deferred revenue is “earned” upon delivery of goods or services to customers.

Second method – inclusion of adjusting entries directly into unadjusted trail balance:

An adjusted trial balance is formatted exactly like an unadjusted trial balance. Three columns are used to display the account names, debits, and credits with the debit balances listed in the left column and the credit balances are listed on the right. A trial balance is an accounting report you put together at the end of an accounting period to ensure the general accounting ledger is correct and the total debits match the total credits. Once the posting is complete and the new balances have been calculated, we prepare the adjusted trial balance. As before, the adjusted trial balance is a listing of all accounts with the ending balances and in this case it would be adjusted balances. A balanced trial balance hints at no apparent accounting error, whereas discrepancies imply an error somewhere in the account balances.

When to use trial balances

It arises when an asset is a sale, but the customer has not yet billed for the same.

Once all balances are transferred to the adjusted trial balance,we sum each of the debit and credit columns. The debit and creditcolumns both total $35,715, which means they are equal and inbalance. Any difference indicates that there is accounting error in the journal entries or in the ledger or in the calculations. To simplify the procedure, we shall use the second method in our example. Now that the trial balance is made, it can be posted to the accounting worksheet and the financial statements can be prepared. There’s also a chance it’ll fail to flag entries incorrectly coded to the wrong accounts, which can ultimately lead to inaccurate financial statements.

Manage your inventory and business easier

- Preparing an adjusted trial balance is thesixth step in the accounting cycle.

- List each account and its balance, and ensure that the total debits equal total credits.

- This balance istransferred to the Interest Receivable account in the debit columnon the adjusted trial balance.

A trial balance plays a major role in the accounting cycle, notably at the end of an accounting period before generating financial statements. Trial balances come in three key types, with each serving a purpose to help create accurate financial statements. It’s one of the first lines of defense against accounting errors and taxes on 401k withdrawals and contributions a pivotal report within double-entry bookkeeping. Let’s look at what a trial balance is, how it works, the various types, and examples. Before proceeding to the preparation of management and financial reports, an Adjusted Trial Balance is prepared. For that, adjustment entries are made to the Unadjusted Trial Balance.

Once an adjusted trial balance is prepared, the company can prepare and issue financial statements and continue the process of closing its books at the end of the accounting cycle. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works.

Once all ledger accounts and their balances are recorded, thedebit and credit columns on the adjusted trial balance are totaledto see if the figures in each column match. The final total in thedebit column must be the same dollar amount that is determined inthe final credit column. After recording adjusting entries, post them to the ledger accounts. This step updates the individual account balances to reflect the adjustments. Ensure that the ledger balances are accurate and match the adjustments made.

Once all necessary adjustments are made, a new second trial balance is prepared to ensure that it is still balanced. The adjusted trial balance is the key point to ensure all debitsand credits are in the general ledger accounts balance beforeinformation is transferred to financial statements. Budgeting foremployee salaries, revenue expectations, sales prices, expensereductions, and long-term growth strategies are all impacted bywhat is provided on the financial statements. An adjusted trial balance is a trial balance which is prepared after the preparation of adjusting entries. Adjusted trial balance contains balances of revenues and expenses along with those of assets, liabilities and equities. Adjusted trial balance can be used directly in the preparation of the statement of changes in stockholders’ equity, income statement and the balance sheet.

As you have learned, the adjusted trial balance is an importantstep in the accounting process. But outside of the accountingdepartment, why is the adjusted trial balance important to the restof the organization? An employee or customer may not immediatelysee the impact of the adjusted trial balance on his or herinvolvement with the company. After adjusting entries are made, an adjusted trial balance can be prepared. There were no Depreciation Expense and Accumulated Depreciation in the unadjusted trial balance. Because of the adjusting entry, they will now have a balance of $720 in the adjusted trial balance.